New York Libertarian Party contests signatures were duplicates and photocopies

Joshua SolomonJuly 14, 2022 in the TIMES UNION. Submitted by Gerri Maslanka (Sag Harbor)

ALBANY — U.S. Rep. Lee Zeldin, the Republican nominee for governor, is unlikely to run on the Independence Party line after the state Board of Elections invalidated nearly 13,000 signatures that were included in his petitions.

Zeldin’s campaign operation had submitted about 52,000 signatures, well above the 45,000 needed to get his name on the third party line, but the disqualified signatures left him well short following the board’s ruling. The filing period ended May 31.

Zeldin’s petitions were challenged by officials with the New York Libertarian Party, who not only contested the signatures were invalid but also noted that about 11,000 of them were photocopied duplicates.

“Republicans talk a lot about election integrity, but the Zeldin campaign attempted to fly under the radar and submit over 11,000 fraudulent signatures in an attempt to get a third line on the ballot,” Andrew Kolstee, secretary of the Libertarian Party, said in a news release Thursday.

Kolstee, who was the objector to the signatures, claimed that the Libertarian Party officials and the campaign of Diane Sare for U.S. Senate found 900 sheets with 11,000 signatures that were photocopies of the original sheets filed by the campaign.

The Board of Elections does not make determinations on fraud related to petition signatures. The issue is pending in court. A spokeswoman for the board said it does not comment on pending litigation.

A judge could potentially overrule the board’s decision, which would leave Zeldin with an outside shot of still appearing on the Independence Party line.

The board ruled Tuesday that 12,868 signatures were invalid, leaving Zeldin with 39,228.

Prior to changes pushed by then-Gov. Andrew M. Cuomo in 2019 that made it more difficult to get onto a statewide ballot for a third party, it was 5,000 signatures needed every four years.

Zeldin’s campaign did not immediately respond to a request for comment.

On Zeldin’s campaign website, it requests people join “Team Zeldin’s Election Integrity Task Force.”

“Our team will be working around the clock now and into November to ensure we have fair elections, but we can’t do it alone,” the campaign’s website states.

In December 2020, Zeldin tweeted that “ballot integrity always matters regardless of the circumstances and regardless of whether the issue impacts one vote or thousands.” He recommended a series of changes, including “signature verification with campaigns able to participate.” His comments came as then-President Donald J. Trump was contesting the results of the election. Zeldin subsequently voted against certifying the results of the presidential election.

Following a recent decision out of a lower court in New York on whether to allow non-citizens the ability to vote in New York City elections, Zeldin issued a statement through his campaign stating that “one person, one vote belongs to U.S. citizens, and no one else!”

“I’m honored to stand shoulder-to-shoulder with the leaders across our state who stood up for election integrity and the rule of law to put an end to it,” Zeldin said last month.

Zeldin is set to face Gov. Kathy Hochul, the Democratic nominee, in the general election on Nov. 8. Zeldin is to appear on the lines of the Republican and Conservative parties while Hochul is set to appear on the Democratic and Working Families Party lines.

“Zeldin submitting 11,000 fake signatures just emphasizes his hypocrisy and proves he is willing to sell New Yorkers another ‘big lie’ to benefit his failing campaign,” state Democratic Party Chairman Jay Jacobs said in a statement. He noted to Zeldin’s backing of Trump’s election fraud concerns in the 2020 presidential election.

Other candidates who were also invalidated that sought to run on the Independence Party line by the board were Zeldin’s running mate, Republican nominee for lieutenant governor Alison Esposito, as well as the Republican candidates for comptroller, Paul Rodriguez, attorney general, Michael Henry, and U.S. Senate, Joe Pinon.

Comments on Twitter (please retweet and “like”):

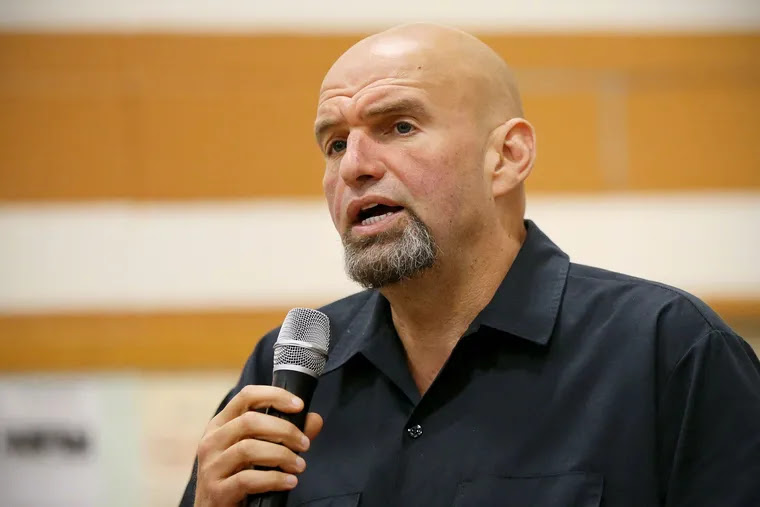

WEDNESDAY, JULY 27, 7:00-8:00pm ET REGISTER + DONATEThe suggested donation is $100 but please be as generous as possible! John Fetterman = tattoos + straight talk + passion + experience + smart john Fetterman is a pull-no-punches Democrat for Pennsylvania’s open Senate seat.

WEDNESDAY, JULY 27, 7:00-8:00pm ET REGISTER + DONATEThe suggested donation is $100 but please be as generous as possible! John Fetterman = tattoos + straight talk + passion + experience + smart john Fetterman is a pull-no-punches Democrat for Pennsylvania’s open Senate seat.